Turn Invoices into Cash

Turn unpaid invoices into working capital in just 24 hours. Boost your cash flow and grow your business

What is Invoice Discounting with Comfi?

Invoice discounting lets you unlock the cash tied up in unpaid invoices. Sell invoices to Comfi for instant payments and stay focused on growing your business.

Get paid now

Get Paid Faster

Convert invoices into cash within 24 hours and avoid waiting for payments

Up to 100%

Finance up to 100% of the invoice without compromising the cash flow

Keep control

Retain customer relationships while streamlining the receiveables

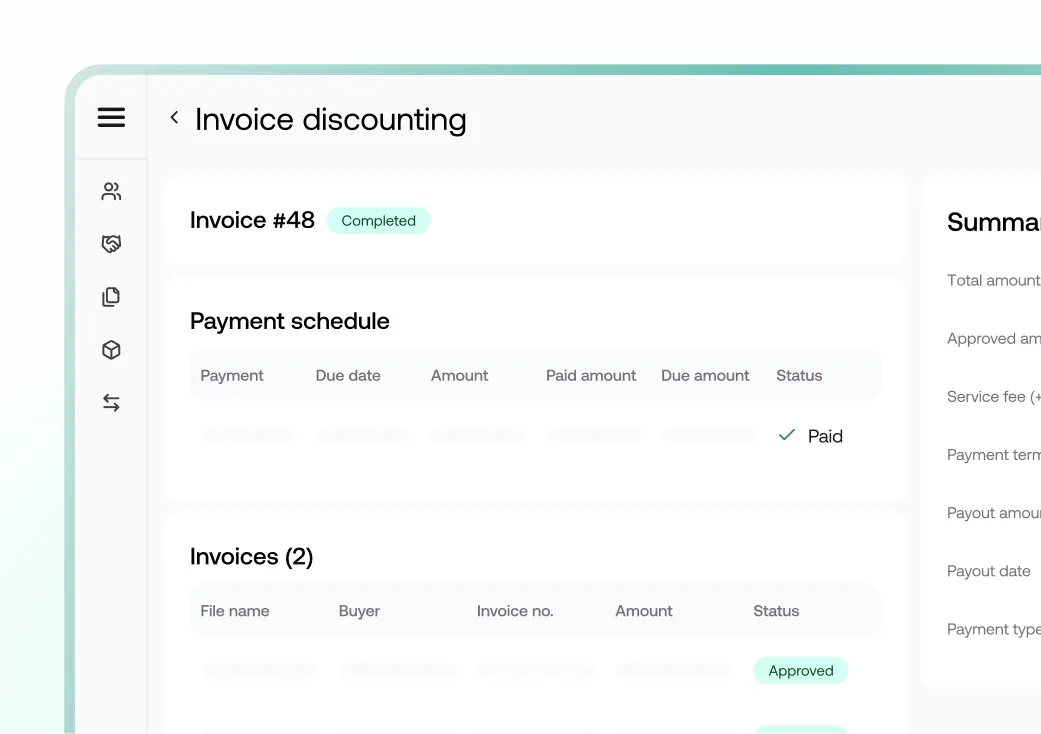

How it works in 3 easy steps

Easier & faster than traditional financing

Submit Invoices

Get Approval

We evaluate and approve your invoices instantly.

Receive Cash

Get up to 100% of your invoice value within 24 hours.

Sync with your accounting software

Submit your invoices easily with our seamless integration with your accounting software

Automated Syncing

Save time

Enhanced Accuracy

Why SME's love Comfi

Real stories of faster growth and stronger cash flow

With Comfi, we take on large projects confidently

Cash flow used to hold us back from scaling media buying budgets or hiring influencers for big projects. With Comfi, we take them on confidently, generate revenue, and settle later.

Our cash flow has never been smoother!

With no more worries about delayed payments, we can focus on growing our business and ensuring timely payments to our suppliers.

The partnership with Comfi marks a groundbreaking development for us

With Comfi powering our transactions, we’ve exponentially grown our deals, establishing ourselves as the top choice for dealers in the auto auction industry.

We are no longer offering any new credit terms unless it goes through Comfi

It’s cost effective to maintain credit business, as they take away all the risk and collection headaches away.”

Comfi ensures upfront payments don’t slow us down

Before Comfi, we turned down bigger campaigns because we couldn’t cover upfront supplier payments. Now we take them on, execute, then settle with Comfi stress-free.

Key highlights

Here’s what makes Comfi different

Up to 95%

Approval rate

In 1 day

Time to cash

Up to 100%

Discount rate

Up to AED 2,000,000

Limit

Pay in 30-90 days

Flexibility

Eligibility & Documents

What do you need to be qualified?

What do you need to provide?

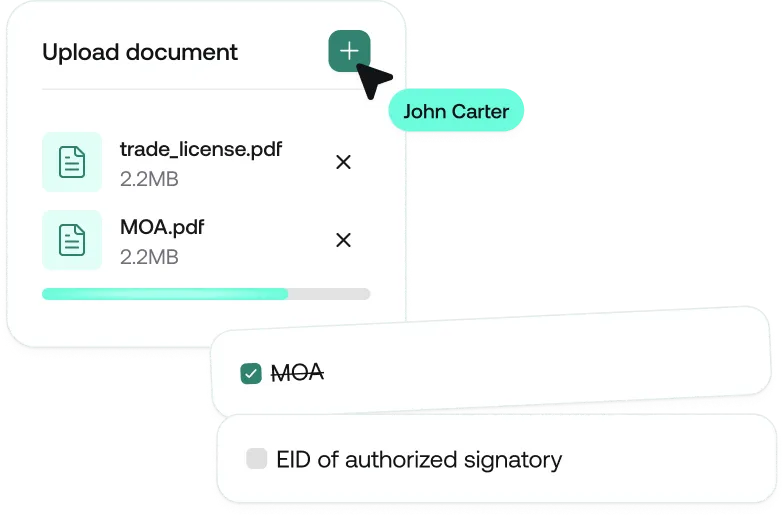

Following our standard KYC & KYB compliance procedures you will be asked to provide the following documents:

Frequently asked questions

Everything you need to know about invoice discounting

What is invoice discounting?

Invoice discounting is a financing solution where businesses receive early payment on their outstanding invoices instead of waiting 30–90 days for buyers to pay. With Comfi, suppliers can unlock immediate cash flow while buyers continue paying on their regular terms.

Who can benefit from invoice discounting?

Invoice discounting is ideal for suppliers, distributors, wholesalers, or service providers who sell to creditworthy B2B buyers and want to improve cash flow, reduce payment delays, and fund operations without taking loans.

How is invoice discounting different from invoice factoring?

Invoice discounting is confidential and keeps customer communication under your control. In factoring, the finance provider collects payments directly from the buyer. Comfi’s model ensures you maintain full ownership of the customer relationship.